How To Apply For Your (IRS) EIN Number

One critical step to officially launching your business is obtaining your IRS EIN Number. If you are not familiar with what this number is, follow along as we break it down in bite size pieces.

Are you launching a new company? Do you own a business in the United States, but have never filed incorporation papers? Are you an aspiring employer?

Then, you should know about EIN and how to file for EIN. Before understanding how to apply for this number, it is essential to understand what this number is about:

This brief tutorial does not assume that you know an EIN is an Employer Identification Number provided by the (IRS) Internal Revenue Service. It also does not assume that you understand why you need one. Our mission is to help you grasp all the above.

For starters, EINs are provided by the IRS for free. There is never a charge for obtaining an EIN. There are no processing fees that the IRS charges applicants.

If you are paying someone to acquire an EIN, you are not paying the IRS.

In fact, the process so seamless it only takes five to ten minutes.

Consequently, it makes no sense to pay someone to do it for you unless you have money to burn and that five to ten minutes is too taxing on your hectic schedule.

Once you apply, there is no waiting period; the IRS immediately assigns your EIN.

WARNING: Be highly cautious if you Google or search for "EIN" using search terms such as:

- Obtain ein

- Obtain ein number

- Acquire ein

- Acquire ein number

- Get ein

- Get ein number

Why? As you scroll through the search results – understand that none of the companies at the top of the search results page are associated with the IRS.

Those are slick for-profit companies that direct you to fill out a lot of unnecessary information the IRS doesn’t even require. When you get to the end and click submit, I promise you will be SLAPPED with sticker shock!

Most of those companies charge fees ranging between $200.00 and $500.00 to process your EIN application. Don’t start your business aspirations off by getting bamboozled.

What Is an EIN?

An EIN or Employer Identification Number is a unique identification number that the Internal Revenue Service assigns to a business for identification purposes.

It is like your social security number, but it is used solely for businesses.

It is a unique 9-digit number encoded to contain information about the state where your company is registered.

Here are some of the things you can do with an EIN number:

- File Your Business Tax Return

- Form a Corporation

- Hire Employees

- Withhold Employees Income Taxes

- Open Business Banking Accounts

- Apply for Business Credit Cards

- Apply for Business Loans

- Obtain Business Trade Lines

- Apply for Government Contracts

- Create Trusts and Estates

- Create a Non-Profit Organization

- Create Partnerships

How To Apply For Your EIN?

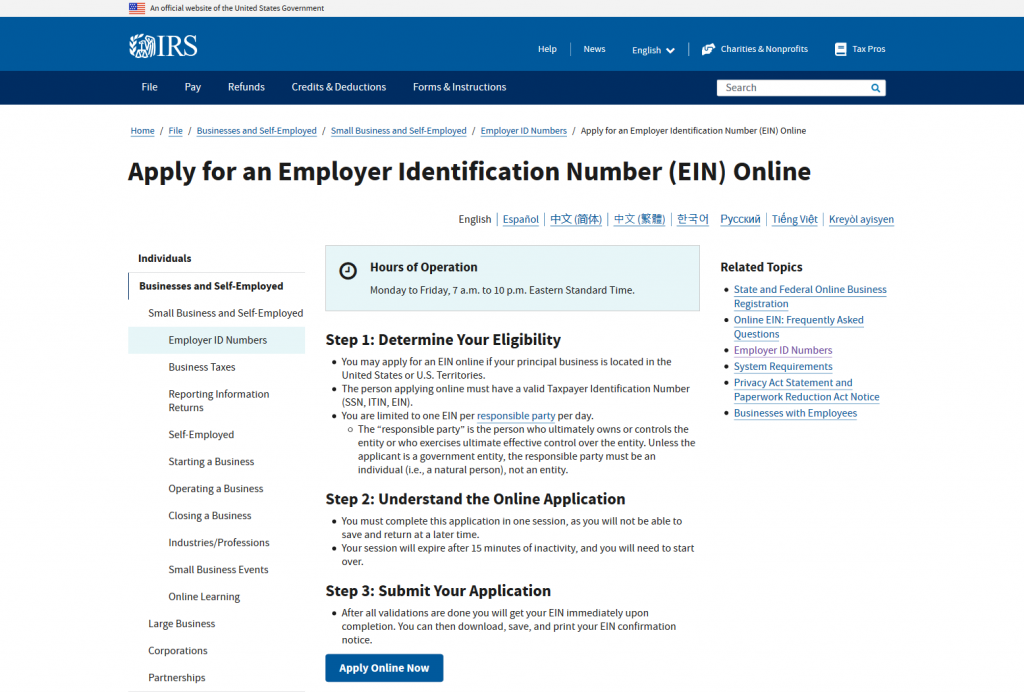

You can apply for an EIN over the phone by fax, online, or through the mail. Even if your business is a single-employee business, you can apply for this number. IRS issues this number without any bias to companies operating within the United States.

Here is the (current) official IRS contact information for obtaining your EIN.

The best way to obtain your EIN is online directly from the IRS. If you call in or use the mailing route, it will take weeks.

If you are unsure about which website you are on, always start at: https://www.irs.gov/

Last note: if you are taking over an existing business or the company’s structure has changed; meaning you went from an LLC to a C Corp, you will need a new EIN.