As you plan, work, and move to build your business empire, at some point, you are going to need to step up your game and organize a Holding Company. In this session, we will answer most of the questions concerning this business tool used by all savvy Entrepreneurs.

One of the most well-known holding companies is Berkshire Hathaway, Inc. Berkshire has assets totaling 707.8 billion dollars as of the day we published this article.

That stated, there are a host of other Holding Companies that eclipse Berkshire by long shots. Mitsubishi UFJ Trust and Banking Corporation currently have 14 Subsidiaries with assets over $2 trillion. HSBC Holdings also has assets over $2 trillion. Credit Agricole is another holding company that boasts of assets over $2 trillion. Those are a few of the top guns.

Once you understand a Holding Company’s power, you will be on your way to building assets like a masterful pro.

What Is a Holding Company?

As the name suggests, a company that is instrumental in controlling other companies is called a holding company. The companies that it holds are called its subsidiaries. The holding company is known to hold them by virtue of owning most of those companies’ shares.

The Powers of a Holding Company

- Carry all the voting rights by virtue of being the most significant stakeholder

- It can also legitimately control the Board of Directors in all the subsidiaries

- Its powers will include making significant decisions

One example of such a decision is that it can determine who should constitute the Board of Directors in the subsidiary companies.

Role of Holding Companies

The holding company is alternatively referred to as the parent company. Most of the time, the parent company does not produce any goods, sales any products, or renders any services. However, this is not a hard and fast rule.

Some parent companies may also participate in active trading and involve themselves in day-to-day business activities of the subsidiary companies apart from holding the majority stake in such companies.

How To Identify a Holding Company

If you were to come across a company that suffixes “holdings” or “holding company” to its name, you could be sure that it is a parent company.

A parent or a holding company can have as many subsidiaries under it; there is absolutely no upper limit to the number of subsidiaries that one parent company can hold.

Some holding companies form a corporate group along with all its subsidiary companies. When this happens, the customers and other stakeholders can be blissfully unaware of such companies’ status.

Without a legitimate reason, it’s literally impossible for anyone to know if the company is a holding company unless and until they are privy to inside information.

Definition of Holding Company Under the US Accounting Standards

The US Accounting Standard 21 defines a subsidiary as “an enterprise controlled by another enterprise (also known as the parent).”

The Advantages of Creating a Holding Company

There are a lot of advantages to having a holding or a parent company. Let us see what they are:

The Subsidiaries Can Maintain Separate Identities

Maintaining separate identities helps companies to look after their goodwill. Typically, the public is not made aware of the holding companies and its ownership of subsidiary companies. In a capitalist society, this can help reap huge benefits.

However, such monopolistic market conditions are not right from the egalitarian society’s point of view.

A Holding Company Makes Economic Sense

When there is a tense debate, and the choice is between having a holding company versus going for mergers and amalgamations, most companies will prefer the former. This is because a holding company invests very little money to control other companies. A merger or an amalgamation requires more investment.

It Is Easy To Shift The Holding Company's Control

Suppose there are concerns of serious nature, and a plan is determined that the holding company be relieved of its status; it is quite effortless to do so. The only step is to sell all the shares of the subsidiary companies held by it in the open market.

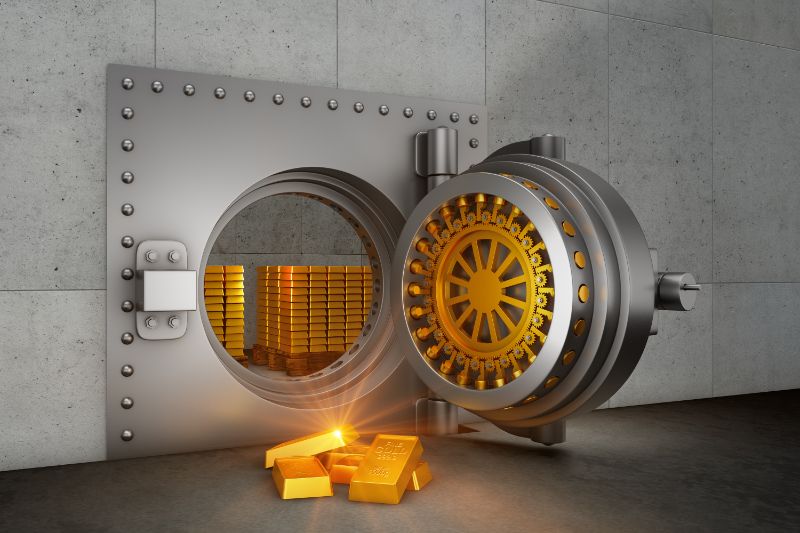

They Help Set Up a Robust Asset Structure

Holding companies help the subsidiaries grow. They also fortify the companies as they chart their growth curve.

The main reason for this is that the holding company is better positioned to provide safeguards against risks.

They also streamline their various businesses, especially when there are some steadily growing and diversifying companies in their fold.

Holding Companies Reduce The Risk For The Shareholders

Because a holding company is permitted to own and control as many different subsidiaries that it wants, it can also be created to hold assets that are tangible such as:

- Physical property

- Tools and equipment

- Inventory/stock

As well as those assets that are non-tangible such as:

- Trade secrets

- Rules of operation

- Other forms of intellectual property may be applicable

Controlled Risk-Taking In Litigation

The holding companies reduce the subsidiary’s risk from litigation from their creditors, private litigants, and other litigants, leaving the subsidiaries to carry on their day to day business activities in peace.

Zero Risks of Losing Valuable Assets

If any of the subsidiaries perform poorly, are litigated against or forced into insolvency, no action can be held against their valuable moveable and immovable properties because it is under the control of the holding company.

However, one exception where they may be made liable is if it is proven beyond doubt that the holding company knew the subsidiary’s poor performance.

Reduces Tax Liabilities

There are a few legitimate ways to do this.

- The holding company can be structured in such a way that it receives lower tax liabilities

- The holding company may be established in a country or in some part of the same country where the corporate tax rates are comparatively lower

Any transfer of dividends from a subsidiary company to its holding company is considered the transfer of cash only and will not attract any taxes.

The Situation In The US

The holding company must hold and own at least 80 percent of the stock in value and the voting powers to claim consolidated tax benefits for its subsidiaries.

The private shareholders must pay usual taxes on the dividends because they are ordinary dividends and not cash transfers.

Takes Strategic Approach

Centralized management paves the way for subsidiary companies to pay attention to their daily trade activities and set their objectives to maximize their profits and grow.

A holding company may:

- Divest of a subsidiary that is not utilizing its resources fully

- Introduce a debt structure that benefits all the subsidiary companies

- Initiate policies that favor individual subsidiary companies if they show promise

- Extend additional support to floundering subsidiaries

The Subsidiaries Can Concentrate On Growth

A holding company can help the subsidiaries to:

- Diversify into various fields effectively

- Invest in newer businesses

- Abandon ventures

Conclusion

Having a holding company is akin to having a big brother watching all the little brothers’ activities. You now know all the advantages of having a holding company.

But there is one more reason why a holding company is desired in the corporate sector. The setup works so that even if the people occupying key positions on the Board of Directors are sued, arrested, fired, or retire; it does not affect the group’s business acumen, branding, or ability to conduct business.

There is never any compromise in the group’s negotiating prowess at all. The companies thus grow from strength to strength in a creative and flexible environment.

In summation, you start off as an Entrepreneur with a single Corporation or LLC. As you grow and expand, forming a Holding Company is your best option in terms of bullet-proofing and increasing your assets.